AI in the New Nordics

By Charles Martin

Introduction

We are in no doubt that AI is a transformational technology, the size of its impact likely determined by the spectrum of possibilities created by AI scaling laws. That said, we contend that despite the monumental changes around us, it is important to not get lost in the hysteria; we must hold on to the things that matter as investors. For Kinnevik's growth strategies (Software, Health & Bio, Climate), this means leveraging their deep sector experience; and for our venture team pairing this with a focus on talent and regional networks.

In this article, we showcase the perspective from our early-stage strategy, mapping out the dynamic nexus of talent in "the New Nordics" and how we think this can lead to the genesis of multiple globally leading AI application companies. In doing so, we also reflect on how AI is transforming the requirements for many of the key roles where talent is needed.

About us

Kinnevik is a multi-billion-dollar investment firm. We make high conviction, long-term investments and think about companies in terms of decades, not 7-year fund horizon windows. We are multi-stage and can support with anything from a EUR 5m to a EUR 100m ticket, from seed to pre-IPO.

As a starting point we have kept our focus on software applications, it is, after all, the area we know best. Our investments here include the following billion / multibillion dollar application companies: TravelPerk, Spring Health, Mews, Pleo, Livongo and Zalando.

We define venture pretty loosely, but as a starting point we do like to see a live product. Anything with proven unit economics and significant commercial scale we would look at alongside our growth team. Typically, this means our venture team operates mostly between seed – Series B stage.

With AI at the early-stage, you operate in an uncertain technology landscape, underpinned by complex interdependencies and rapid change. To try and cut through the noise we look for a few things, in particular a significant and measurable “why” (typically: LLMs mean you can now do X, resulting in Y outcome for this use case). Most critically, we find that in such a dynamic landscape one needs to practise mental plasticity, and that it is important to not get anchored too heavily to anything other than a great team: as such we always start with team and are uncompromising here.

We think the Nordics (defined here as “new Nordics”, i.e. Nordics and Baltics) is a good starting point for our venture strategy to zone in on great AI teams given our heritage in building and investing in companies in the region. Indeed, our Nordic portfolio includes multiple unicorns, including: Pleo, Stegra and Instabee, alongside exciting up and comers Agreena and Aira (with others in “stealth”). Given this, we know (and are known by) most of the leading operators and investors in the region.

Why the new Nordics?

Perhaps due to a lack of frontier AI / foundational model businesses being built in the region, there has been a narrative amongst many European VCs that the region is unlikely to produce great AI companies in other parts of the stack, this is a sentiment we do not share (just look at Swedish based Sana, one of the leading AI application companies in Europe).

In the Nordics we think of three people-related factors that lay the foundations for building leading AI application companies: i) technical talent, ii) operational talent, and iii) an “inventive mindset”.

Technical Talent

In terms of pure AI technical talent, the new Nordics has high quality but lower quantity; crucially supply/availability of talent is high. We think this combination of high quality and supply creates a great dynamic for company building.

Quality:

The quality comes in part from their leading research institutes (e.g. DTU, KTH, Aalto etc.), but particularly from the several global technology companies with AI capabilities in the region (Spotify, Klarna, Novo, Cognite, Silo AI, Sana).

We also note the many nomadic tech workers hailing from the region, with high ranking talent at OpenAI, DeepMind, Anthropic etc. Indeed, we find at least 50 Nordic tech nomads working in technical research roles at the top 5 (by market share) LLM providers. Whether they will come back to start/join companies is one question, but it speaks to a certain level of quality.

Other notable technical talents hailing from the Nordics and Baltics include Peter Salanki (Coreweave CTO), Peter Welinder (OpenAI VP Product) and Ali Ghodsi (CEO and co-founder at Databricks). Thanks to Oliver Molander (who provides some fantastic content on AI in the Nordics) for pointing this out.

Supply/availability:

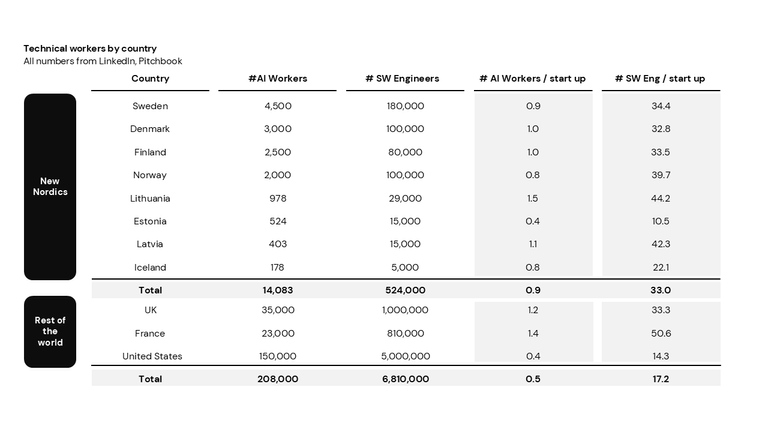

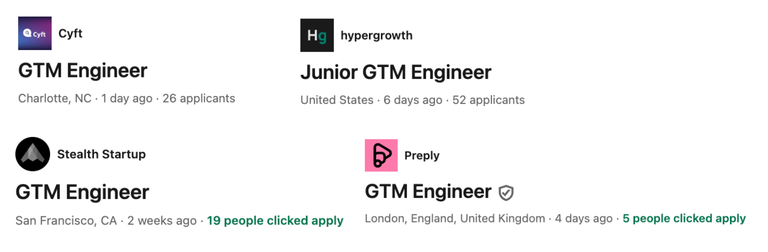

As is expected, the region has a lower total “quantity”. That said, we think the more relevant question relates to labour supply, which we look at on a per startup basis. As we can see in the data below, Nordic and Baltic countries on average have more “technical AI workers” available per startup than the combined average of the US, UK and France (noting here the average is counterintuitively dragged down by the US).

We have also broken out the “n” of more conventional software engineers (“SW” below) in each region. As we can see the region also has a more abundant supply of conventional software engineers when viewed on a per startup basis.

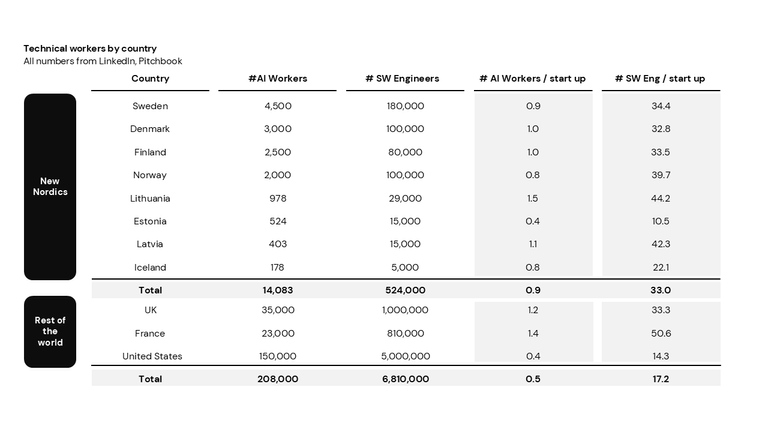

This abundance of regular software engineers is important for application companies working with AI, where we see less need for “research heavy” talent, with more of a need for hybrid roles. The team at latent space have dubbed this hybrid role the “AI engineer”. AI engineers have software engineering backgrounds and multi-faceted skill sets; their role is to productise and orchestrate workflows above the API (see graphic below). “AI engineers” come from a more abundant supply than AI PHDs and researchers, which to some degree have been cornered by the model providers (eg 5k LLM researchers vs 50m software engineers). Interestingly, when we speak to leading application companies in our portfolio, they have gotten far more leverage from “upskilling their best engineers” on AI than hiring a bunch of highly qualified AI researchers and PHDs.

This high concentration in technical skills has emerged from decades of far-sighted governmental policy, e.g. in subsidising internet/computer access and integrating technology into the core curriculum. Indeed, Sebastian Siemiatkowski (Klarna CEO) learnt to code via such a scheme in Sweden.

Operational talent

There is less to say here that hasn’t already been said before. The new Nordics has a healthy pool of non-technical operational talent, drawing from the numerous sales/marketing/finance professionals that have gone from 1-10, 10-100, 100+ at the many tech companies to come out of the region.

As we observe in our own portfolio, AI is ripping up the operational playbook in real-time, from CS to R&D to S&M. Indeed, we have seen large scale ups in our portfolio literally add 15 percentage points in gross margin from embedding AI across CS. At the earlier stage, our best guess is that leverage from AI is translating into 20%-40% smaller teams.

Our takeaway here is that one of the factors that will determine the success of AI application companies is the degree to which they have embedded AI across their operations – after all, it is hard to compete with a rival that has structurally higher margins than you. As software costs fall and it gets easier to ship product, I think it is fair to assume companies will need to rely increasingly on a highly bespoke operating stack in order to achieve a decisive advantage vs peers.

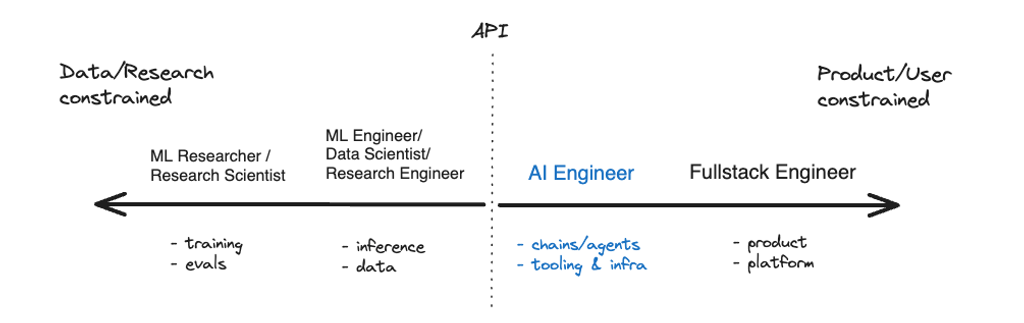

We see this already with (non-Nordic) Clay, who have pioneered the use of “GTM engineers”, they contend that the different roles in outbound will collapse to a “single-high leverage function, that looks more like an engineering organisation…sales teams will build automated systems that can reach thousands of prospects without adding headcount. Instead of each person working independently, they'll collaborate on reusable solutions that scale”. Swedish based Klarna have also showcased the potential for organisations to get material leverage from curating their own operating stack that uses AI – perhaps their influence will diffuse out through the region.

“Inventive mindset”; creative and disruptive thinking

Technology is everywhere, innovative thinking is not. For me this is the hardest factor to define, but perhaps the most important. It is a dimension upon which the region excels.

When we look at the c.30 million inhabitants of the new Nordics they clearly punch well above their weight when it comes to creating mammoth, iconic companies. A lot of this emerges from certain creative and disruptive traits.

I spent 2 years living in Sweden, for the first 6 months it was not obvious to me how a seemingly “risk off” and socially compliant populace could be behind so much innovation. That said, the data speaks for itself:

- Sweden, Denmark and Finland are the “three innovation leaders in the EU”, ranked top 3 and significantly ahead of the other 27 member states; these three countries also consistently rank in the top 10 global Innovation Index

- Nordic countries lead other European countries significantly on pretty much any per capita indicator for innovation, including unicorns / capita, fundraising / capita, R&D as a % GDP etc

Without delving too deeply into innovation/social theory or referencing Scandi design styles (the ultimate cliché in writing about the Nordics), I want to point to three “founder archetypes” I admire; all of which bear witness to the very high “innovativeness” of founders in the region.

“Disruptive, product orientated founders, with platform mindsets”

The tendency we see in the region to tear down ineffective paradigms speaks a lot to us at Kinnevik, given our history around financing/building companies intended to challenge entrenched monopolies (e.g. Tele2).

In software, we see several founders who pair a “I cannot accept this attitude” with expansive product visions and a focus on data foundations. Jonathan Sanders, the founder of Light (Copenhagen based), epitomises this, Light pair a cutting-edge approach to data infrastructure with great UI, offering a more integrated, performant alternative to the modern ERP, bringing together several point functions. In a similar vein, Tuomo Riekki and Santtu Koivumäki from Zero (Helsinki based), have reinvented the CRM by unifying disparate point solutions into one AI augmented platform underpinned by a strong data layer.

Interestingly, Zero and Light find common ground in their remedy: i) integrating applications on top of solid data foundations (critical for reliability in AI and building “compound AI)”, ii) developing more expansive solutions, fostering a “point to platform” dynamic. This is a model we find to be particularly compelling.

“Opinionated, tasteful and empathetic product curators” (a concept repurposed from Akash Bajwa)

Whether it is the many consumer facing (Spotify, Klarna), or consumerised B2B software companies (like Pleo), companies from the region lead with design and great UX. Moats are likely to persist in software (data+workflows), but competition will certainly increase as GenAI reduces barriers to entry (particularly around software costs). As such, “Taste” (a multi-faceted skill harder to replicate using AI) will remain a critical determinant of success and core to building initial engagement via a compelling “wedge”.

Stockholm based Anton Osika, the founder of Lovable (an AI full stack developer platform), is regarded as one of the most promising talents in the region and exemplifies this persona. Lovable has had remarkable ARR traction, all engendered by a beautifully curated product with sleek design and sophisticated engineering behind the scenes to improve intent translation, both of which make this the most effective, rewarding product vs peers.

“Rebels with a cause”.

I am not sure what they were putting in the water 20 years ago (probably nothing, Nordic water is, unsurprisingly, very good), but there is a new generation of entrepreneurs in their early 20s building very exciting companies, in many cases jumping straight into entrepreneurship out of university and in some cases dropping out of school altogether. Max Junestrand from Leya was the archetype here, stepping pretty much straight out of KTH into founding Leya, going on to raise from Benchmark, Redpoint and others. We also see several young, technical and highly talented founders/teams at: Dendrite (shoutout my fellow “Charles”) Parahelp, Qura law, Andon Labs and Reworks (to name a few).

I’m sure there are many interesting theories to explain this phenomenon. To try my hand at a little casual empiricism, the Nordics is actually on the whole a fairly socially compliant society underpinned by strong social norms and career paths / expectations, a dynamic I saw all too well growing up in the UK. In the same way many rock stars were raised in strong religious households, I suspect that for certain young people, the stronger the orthodoxy, the stronger the rejection of it.

There is no truer way than start-ups to increase the “beta” of your life trajectory.

Conclusion

There is a framework that is useful here called historical determinism, it holds that certain outcomes become inevitable, ie are path dependent, given past underlying conditions and events.

In the New Nordics, these factors have birthed an ecosystem, out of which comes an eddying stream of very unique and very exceptional people. Perhaps they were able to access a computer at a young age (subsidised by the state), perhaps they want to apply their years of scale up experience at an earlier stage, perhaps they just want to rebel against the orthodoxy.

This small, but potent region has proven itself on the global stage before and I have high conviction it will do so again in the age of AI.

In partnership with Operators and Friends, we will be holding an event for founders / operators on February 19th in Stockholm. If if you would like to join please apply here.

If you have a product and are building AI applications in the “New Nordics”, we would like to chat. Please reach out here.